What Is a Fonds Commun de Placement à Risque (FCPR)?

Investing in an FCPR provides an entry point into the world of private equity. This investment vehicle pools investors within an private assets fund in order to finance private companies or projects. FCPRs are regulated and approved by the French financial regulator (AMF).

Subscribing to an FCPR means investing in a portfolio composed primarily of European SMEs and mid-caps. Regulations require that at least 50% of assets be invested in private European companies.

Read the press release: Private Corner launches its first FCPR focused on the European mid-market: FCPR European MidMarket Opportunities

The Rise of FCPRs

Created in 1983, FCPRs were designed to direct household savings towards the financing of private companies, relying on a regulated legal and tax framework that protects individual investors.

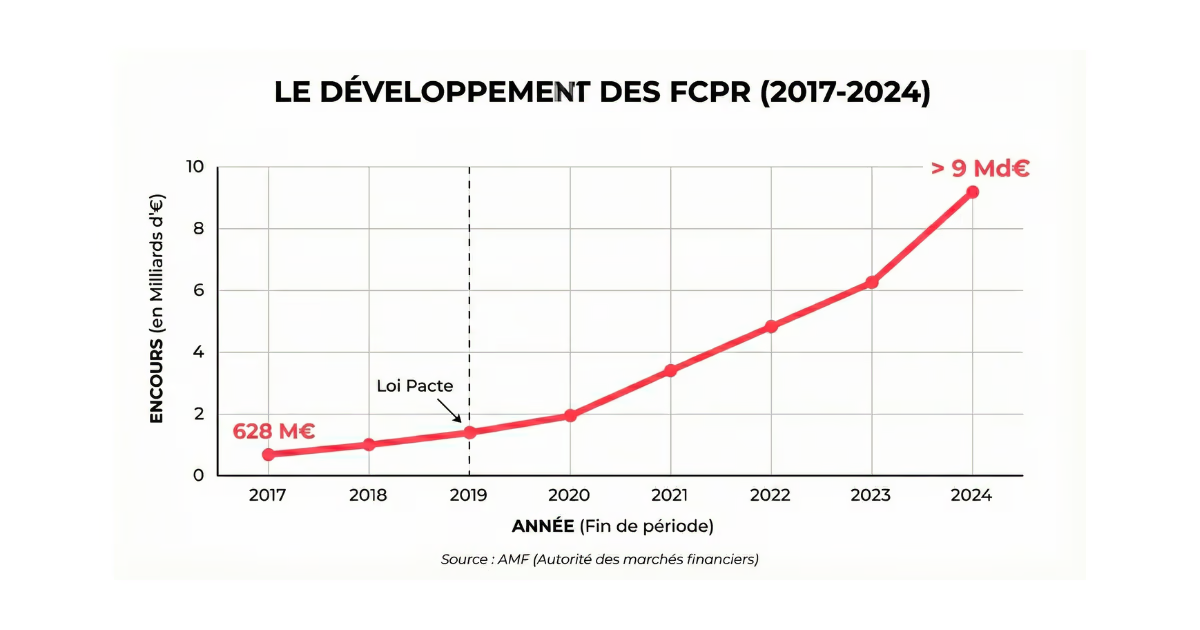

Their development has accelerated significantly in recent years: between the end of 2017 and the end of 2024, assets under management grew from €628 million to more than €9 billion, according to the AMF. AMF source

How Does an FCPR Work?

Let us consider a “classic” FCPR, i.e. a fund with a limited subscription period during which investors may buy units. Once this window closes, the fund becomes “closed” to new investors, who must then wait until the end of the fund’s life to exit.

During the investment period, the management company identifies high-potential private companies, gradually deploys the committed capital, and then supports these companies over several years (strategic guidance, governance, preparation for exit, etc.).

At maturity, the fund enters a pre-liquidation phase followed by dissolution/liquidation: holdings are sold, monitoring activities cease, and the proceeds (including any capital gains) are distributed to investors until the fund is fully wound down.

The Role of an FCPR in Building Wealth

FCPRs are intended for sophisticated investors capable of bearing capital-loss risk and a long investment horizon, often 8–10 years or more.

The minimum investment threshold is much lower than for professional funds. At Private Corner, access begins at €20,000.

To better understand how a private equity investment platform can facilitate access to these solutions and professionalize fund selection, consult our dedicated Q&A.

How to Choose an FCPR?

When an FCPR is structured as a fund of funds, as is the case at Private Corner, it is essential to assess the quality of the target fund managers: performance track-record, team stability, depth of deal flow, and sector specialization (mid-cap, small-cap, tech, infrastructure, private debt, etc.). The FCPR manager must show strict selectivity before including any strategy.

The composition of Private Corner’s FCPR relies on a structured selection process grounded in qualitative and quantitative criteria. The investment universe includes strategies managed by firms with proven experience and a performance track-record across multiple vintages.

It is also important to assess whether the fund’s investment philosophy is aligned with the end-investor’s goals. Beyond the investment strategy (buyout, growth, secondary, etc.), attention should be paid to the fund’s structure (evergreen or closed-ended, with or without tax benefits), the level of diversification (number of holdings, sector/geographic mix), and the fee structure: subscription fees, annual management fees, carried interest.

Finally, monitoring the evolution of the fund requires understanding how performance is measured (IRR, TVPI, DPI, net of fees). We explain these concepts in our Q&A: How to measure the performance of a private equity investment? .

What Are the Benefits of Investing in an FCPR?

FCPRs provide access to private markets and broaden portfolio diversification beyond traditional listed assets. By investing in high-potential SMEs and mid-caps, the investor gains exposure to a historically higher-return asset class over the long term—while accepting higher risk and a long investment horizon.

Because holdings are not valued continuously on a public market, apparent volatility is lower than in listed markets. Finally, this investment directly finances the real economy by supporting innovative companies, growth, and employment.

See also: Why private clients need education before investing in private markets

What Are the Risks of Investing in an FCPR?

The primary risk is capital loss: private companies naturally carry higher uncertainty, and not all will achieve their development plans. The performance of a fund of funds structured as an FCPR depends heavily on the manager’s ability to select high-quality GPs.

There is also a significant liquidity risk: invested capital is locked up for the fund’s entire lifespan, without the possibility of early redemptions under favorable conditions. Investors must therefore be willing to immobilize their capital for many years and avoid investing money they might need in the short or medium term.

We explain how this illiquidity can also become a performance driver in private markets in this dedicated article.

Why FCPRs Matter for Wealth Advisors and Their Clients

For wealth managers and private bankers, an FCPR is a differentiating solution to strengthen clients’ private equity allocation while leveraging Private Corner’s expertise in selecting leading European mid-market managers such as Eurazeo, Keensight Capital, and PAI Partners. By lowering entry barriers and offering flexible structuring, Private Corner enables a broader investor base to capture performance opportunities aligned with their wealth objectives.

To learn more about how Private Corner connects investors with managers and curates high-quality opportunities, you can also read our Q&A: What is the impact of a private equity investment platform? .

Frequently Asked Questions About FCPRs

Is an FCPR suitable for all types of investors?

No. FCPRs are designed for sophisticated investors capable of tolerating a long lock-up period (typically 8–10 years) and the risk of capital loss. They should be considered part of a long-term wealth strategy, not a short-term liquidity solution.

What share of my portfolio should be allocated to an FCPR?

The allocation to private markets depends on personal circumstances, investment horizon, and risk tolerance. In practice, FCPRs usually represent a minor allocation within a diversified portfolio, complementing liquid assets such as bonds, cash products, or listed equities. This allocation should be determined with a wealth advisor.

Can I exit an FCPR before it matures?

Generally, no. “Classic” FCPRs are closed-end funds: units cannot be redeemed at any time, and investors must wait for the progressive liquidation of the portfolio. Some secondary transfer mechanisms may exist but do not guarantee liquidity or price.

How is FCPR performance measured?

FCPR performance is assessed using private equity metrics: IRR, TVPI, DPI. These indicators should be evaluated over the fund’s full life. For more details, see our dedicated Q&A on performance.

How does an FCPR differ from other private equity vehicles?

An FCPR is a French regulated vehicle accessible to non-professional investors, with diversification rules and private-markets investment quotas. Other structures (FPCI, SLP, professional funds) are typically reserved for qualified investors with higher minimum commitments. The choice depends on the investor’s profile and regulatory framework.

Does an FCPR offer tax benefits?

Some FCPRs may be eligible for specific tax incentives depending on their structure and the investment wrapper used (securities account, life insurance, PEA-PME, etc.). However, tax benefits should not be the sole driver of the decision: investment strategy, manager quality, and risk level remain fundamental.

What are the main criteria to review before subscribing?

Key factors include: investment strategy (buyout, growth, secondary, private debt…), the quality and experience of the management teams, track-record, diversification level, fees, and fund duration. For a fund of funds, rigorous GP selection is crucial.