What Is a Semiconductor and Why Is It Essential?

A semiconductor is a key building block of the digital economy. This material enables the functioning of virtually all modern electronic devices. A smartphone alone contains around 160 semiconductors.

Because it can either conduct or block electrical current depending on the need, the semiconductor plays a critical role in emerging technologies, including artificial intelligence, cloud computing, data centers, and electric mobility. An electric vehicle can contain more than 1,000 semiconductors.

Semiconductors are therefore more than a technical component — they actively reshape technological and industrial value chains.

Read the press release: Launch of the Private Corner Wealth European Semiconductor feeder fund.

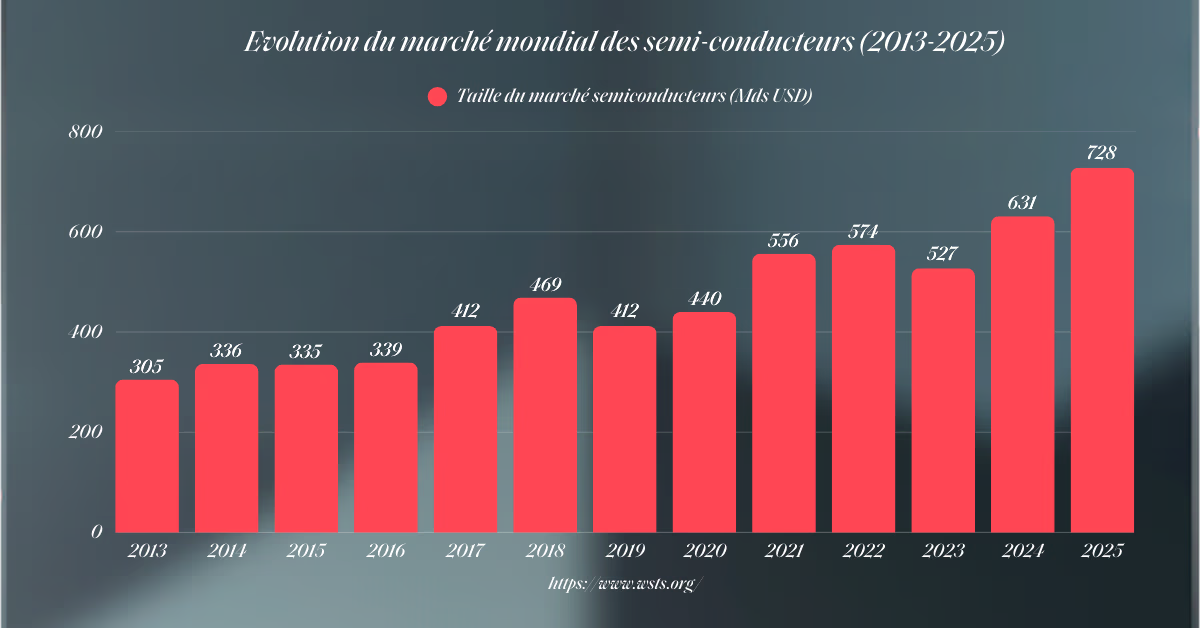

A Fast-Growing Global Semiconductor Market

The global semiconductor market is expected to reach nearly USD 701 billion by the end of 2025 according to the WSTS, and to surpass USD 1 trillion by 2030 according to McKinsey.

This sustained growth is driven by three major megatrends:

- The rise of artificial intelligence and generative models, requiring increasingly powerful processors;

- The energy transition, driven by electric vehicles and smart grids;

- Ubiquitous connectivity, boosted by 5G and the Internet of Things.

Semiconductor manufacturers expect a 29% increase in demand by the end of 2026 according to Capgemini — twice the industry's own forecasts.

A Strategic European Sovereignty Issue

In a context of reindustrialization and supply chain security, investing in this sector means supporting a rapidly expanding market while contributing to Europe’s technological sovereignty.

Today, the European Union produces only about 10% of global semiconductors, while nearly 80% of key suppliers are located outside Europe. This strategic dependency pushes the EU to make semiconductors a central pillar of its industrial policy. The European Chips Act clearly states:

To reach this target, Europe is heavily supporting new manufacturing capacity to reduce dependency on Asia and the United States.

A Thematic Fund Dedicated to the European Semiconductor Value Chain

In this context, Ardian launched Ardian Semiconductor, an investment strategy dedicated to the European semiconductor value chain, in exclusive partnership with Silian Partners, a team of highly recognized semiconductor experts.

The strategy aims to:

- Support the development of strategic technologies;

- Accelerate growth driven by deep trends: AI, electrification, automation, defense;

- Strengthen Europe’s position in a sector crucial to competitiveness.

Building Europe’s Future Semiconductor Champions

Ardian has already announced its first investments aligned with its ambition to build strategic European semiconductor leaders. These include two French companies operating in critical technological niches:

- Ion Beam Services, a specialist in ion implantation equipment and services — a key manufacturing step;

- Synergie Cad Group, a leader in test interfaces for major semiconductor manufacturers.

Why Access a Semiconductor Fund Through Private Corner?

At Private Corner, we identify and select thematic funds aligned with major transitions for our satellite fund range. In the technology theme, we focus on strategies that offer exposure to high-growth, strategic sectors while integrating sustainability and sovereignty criteria.

Investing in a semiconductor-focused private equity fund through Private Corner provides:

- Rigorous analysis of opportunities across the full value chain;

- Privileged access to specialized managers like Ardian and Silian Partners;

- Educational and strategic support to align performance with long-term impact.

Private Corner also provides wealth and asset management professionals with a secure digital platform dedicated to private market investments — accessible from €100,000 — giving access to institutional-grade funds. Learn more about how the platform works in our guide: Private Equity Investment Platform.

Benefits and Risks for Private Investors

For private investors, investing in semiconductors through private equity provides potentially high returns and exposure to a strategically essential sector.

However, private equity investments are generally illiquid, long-term, and carry higher risk — including capital loss — particularly due to concentration in non-listed companies.

Proper financial analysis and professional advice are essential before investing in private equity funds.

To better understand private market specificities, read our educational article: Why Private Investors Need Education Before Investing in Private Markets.

FAQ

What is a semiconductor?

A semiconductor is a material that can conduct or block electricity depending on conditions. It is essential for AI, cloud, data centers, and electric mobility.

How do I invest in a semiconductor private equity fund?

Through specialized private equity funds targeting the semiconductor value chain. Private Corner provides access to these thematic funds.

Which platforms allow investing in semiconductor companies?

Private Corner offers a secure digital platform dedicated to private markets, including semiconductor-focused funds.

What are the best semiconductor-focused funds?

Among the most advanced strategies is Ardian Semiconductor, developed with semiconductor experts Silian Partners — accessible through Private Corner.

What are the risks?

Private equity involves illiquidity, long time horizons, and a risk of capital loss. Always read the fund documentation and consult a financial advisor.