Why invest in private equity in 2026?

According to McKinsey, private assets reached $13 trillion in assets under management (AUM) in 2023, with an average annual growth rate of +12% since 2015.

In France, private markets have also established themselves as a cornerstone of asset allocation, supported by regulatory developments such as the Pacte Law and subsequently the Green Industry Law (Loi Industrie Verte), thereby directing long-term savings towards growth and industrial transitions.

Furthermore, uncertainty regarding interest rates, economic growth, and geopolitical tensions increases the appeal of counter-cyclical strategies grounded in operational value creation. Private equity, infrastructure, and private debt thus appear as diversification levers capable of preserving value in a persistently volatile environment.

There is no "market timing"

In private assets, the entry point matters little: capital calls spread over 4 to 5 years create a natural smoothing of cycles. A detailed analysis is proposed in our article on market timing in private markets.

Performance relies primarily on:

- the quality of the manager (GP),

- the robustness of the investment process,

- the strategies' ability to withstand periods of stress.

There is no "ideal weight"

Usual allocations range between 5% and 15% of financial wealth, or more for investors with strong liquidity capacity and a long horizon. The optimal weight, however, remains specific to each situation: age, wealth objectives, savings capacity, and risk tolerance.

Diversification is key in 2026

Diversifying in 2026 means building a pocket that combines multiple performance drivers and varying cash-flow rhythms. Concretely, a robust allocation tends to assemble:

- a historical core (Buyout, Growth Equity),

- strategies with increased velocity (Co-investment, Secondaries),

- more resilient or distributive pockets (Private Debt, Infrastructure).

Historical performance superior to listed markets

Over the long term, private equity has shown a structural ability to outperform public markets, driven by two factors: operational value creation and the illiquidity premium.

In normal cycle phases, the manager acts as a strategic partner to companies, which illustrates the performance differential compared to listed indices.

Between 2019 and 2023, global private equity generated an annualized performance of nearly 16%, outperforming the MSCI ACWI by about 8 percentage points. This substantial gap reminds us of a reality well known to institutional investors: value creation in private markets depends heavily on the quality of the managers. The global average hides considerable gaps between top-performing funds and those at the bottom of the distribution, highlighting how crucial manager selection is in building a high-performing portfolio.

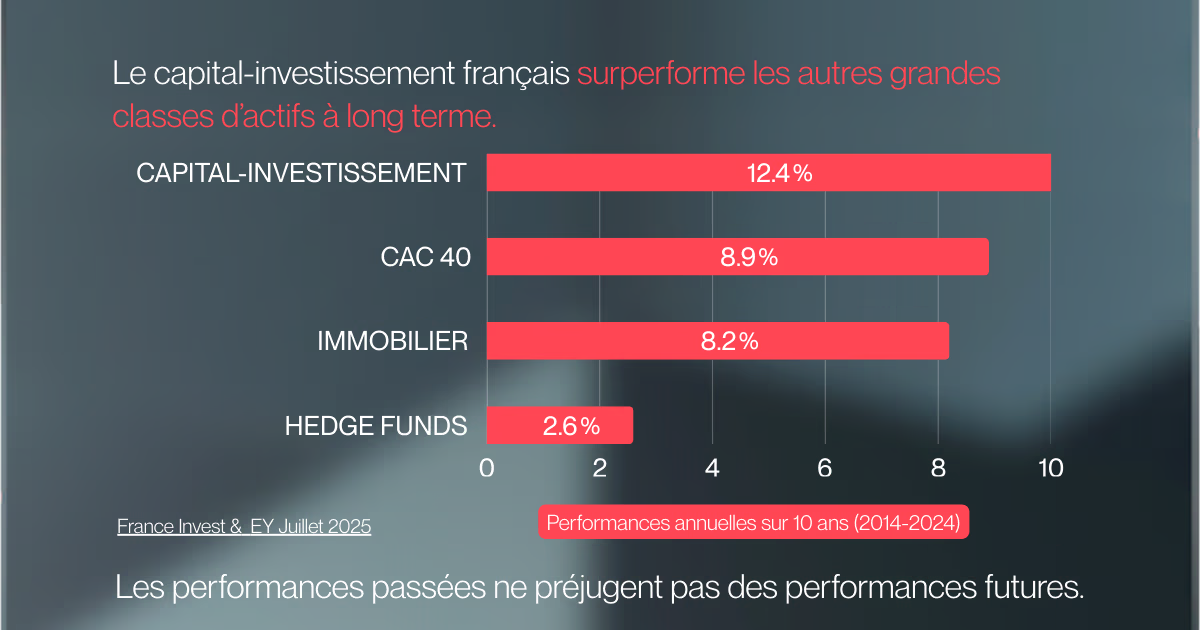

In the French market, this trend is confirmed over time. According to France Invest, private equity posted an annualized return of 12.4% over the 2014–2024 period, a clear outperformance compared to other asset classes.

Patrimonial diversification and asset decorrelation

Private asset valuations do not react to daily fluctuations like the stock market: they are based on tangible fundamentals — EBITDA, cash flows, long-term contracts. The investor is thus less exposed to immediate volatility and benefits from a smoother trajectory, improving the risk/return profile and cushioning stock market stress phases.

Beyond simple diversification vis-à-vis listed assets, the maturity of the private asset class opens up multiple internal axes of diversification:

- by managers, to reduce selection risk;

- by strategies (primary, secondary, co-investments, private debt, infrastructure), to combine multiple sources of alpha;

- by vintages, to smooth exposure to cycles;

- by geographies and sectors, to capture complementary growth drivers.

Access to the real economy and growing companies

Investing in private equity means financing the growth and transformation of unlisted companies. The investor becomes a shareholder of companies that are often leaders, well before an industrial sale or an IPO.

How to invest in private equity: the different strategies

Private equity encompasses several strategies with distinct performance drivers. Understanding them helps choose the brick adapted to each portfolio and objective.

Primary private equity: investing in new funds

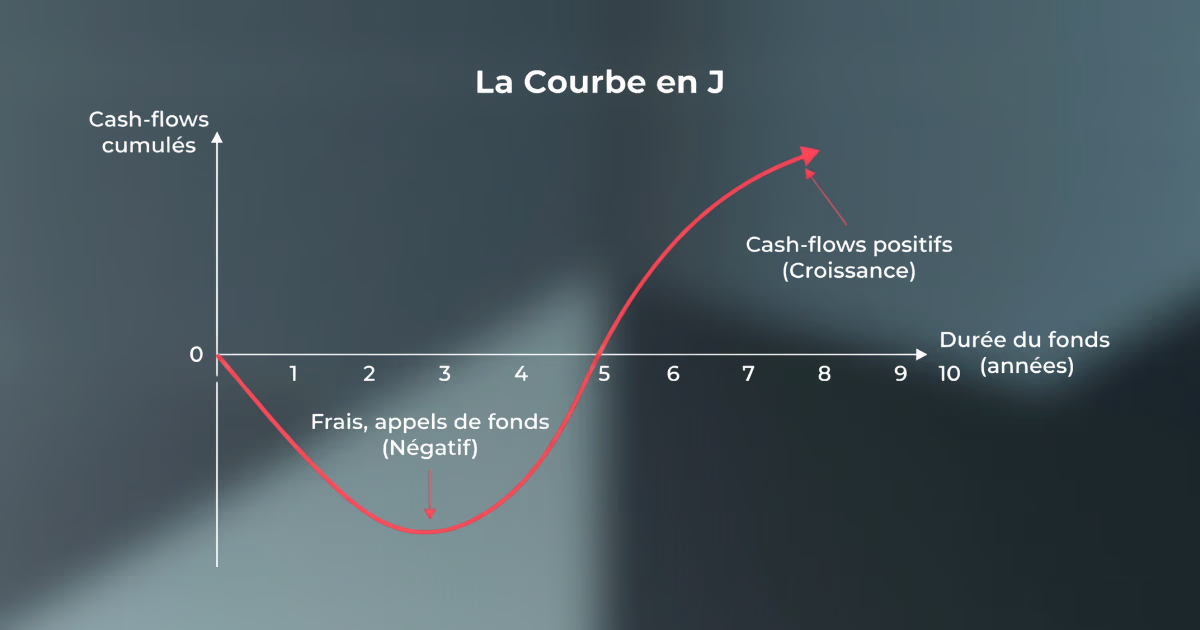

The primary market corresponds to subscribing to a fund during its fundraising period. Committed capital is called progressively during the investment period (generally 5 years), then returned via distributions as exits occur. Managers create value by selecting companies, supporting them operationally, and then arbitrating at the most favorable moment.

Primary investing allows capturing the full value creation of a vintage from launch. Note that the bulk of the return on investment materializes beyond the fifth year.

Secondary market: liquidity opportunities and discount

Secondaries is a market allowing the acquisition of fund shares or fund assets that are already invested. It applies to all private asset classes (private equity, private debt, infrastructure). Two main formats dominate: LP-led transactions (initiated by investors wishing to sell their positions) and GP-led operations or continuation funds (initiated by managers to extend a mature asset in a new vehicle).

For the investor, secondaries offer concrete advantages:

- clear visibility on portfolios, as they are already constituted;

- faster distributions thanks to advanced maturity;

- frequent discount at entry, improving potential returns.

Direct co-investment alongside managers

Co-investment funds provide access to selected participations alongside top-tier managers, while allowing broader diversification than a classic primary fund. They generally gather around 50 minority operations, alongside leading funds, guaranteeing institutional execution discipline and total alignment on the main deal's terms.

| Primary | Secondary | Co-invest |

|---|---|---|

| Subscription during fundraising | Already invested funds | Direct participation |

| Long J-Curve | Rapid Cashflows | High Velocity |

| Full Performance | Discount | Strong Alignment |

In summary: primary captures the full performance of a vintage, secondary accelerates and secures cash flows, co-investment increases exposure precision.

Private Corner: the institutional platform for investing in private equity

AMF-regulated management company and digital native

Private Corner is a 100% B2B management company, regulated by the AMF (French Financial Markets Authority), specializing in private assets. Its secure digital platform is exclusively designed for Wealth Management Advisors, Family Offices, and Private Banks. The ambition is to institutionalize access to private markets for partners' private clients, replicating the tracking, transparency, and reporting standards of professional investors.

Access to top-tier institutional managers

Selection is the core of the model. Private Corner focuses notably on teams with a demonstrated track record over several vintages, disciplined execution across cycles, and an ability to create value over the long term. Each strategy undergoes thorough due diligence covering past performance, investment process, team stability, alignment of interests, ESG framework, and financial terms.

Minimum investment from €20,000

Institutional strategies often require a direct minimum ticket of €5m to €10m. Private Corner structures feeder funds or pure-brick funds of funds, pooling tickets to make them accessible from €100,000 (and sometimes from €20,000 via certain vehicles). This democratization is done without degrading the underlying strategy, with Private Corner funds charging very low fees.

| Indicator | Benchmark |

|---|---|

| Cumulative Fundraising | €1bn |

| Distributor Partners | 420+ |

| Private Investors Supported | 4 200+ |

| Funds Managed | 40 |

| Access Ticket via Feeders | from €20,000 |

Asset classes for investing in private equity

Private equity fits into a broader allocation of private assets, each playing a specific role in portfolio construction.

Buyout and Growth Equity

Buyout (capital-transmission) and Growth Equity (capital-croissance) constitute the historical foundations of private equity.

- Buyout targets mature and profitable companies, where value comes mainly from strategic execution: operational optimization, team strengthening, external growth, financial discipline.

- Growth Equity finances the acceleration of already profitable companies positioned in buoyant markets, providing capital, sector expertise, networks, and model structuring.

These two approaches offer a balanced risk/return profile with a common principle: investing in quality companies and creating value through operational transformation.

Private Debt

Private debt funds finance companies outside the banking circuit via instruments adapted to their specific needs: unitranche, mezzanine, senior secured, or Capital Solutions.

Mid-market strategies target intermediate companies in growth, transmission, or repositioning phases, where managers can structure bespoke financing integrating covenants, guarantees, control clauses, and profit-sharing mechanisms.

For the investor, a private debt fund presents three major assets:

- Predictable income, generally in the form of annual or semi-annual coupons.

- Controlled risk, thanks to a seniority rank higher than shareholders and framed legal documentation.

- Rapid deployment of capital, making it an excellent stabilizer within a private assets pocket.

These strategies play a structuring role in an institutional allocation as a portfolio core: they bring resilience, regular flows, and increased visibility, while capturing an attractive yield premium compared to listed debt or traditional bond markets.

Infrastructure: Brownfield and Greenfield assets

Investing in private infrastructure finances essential real assets — energy, transport, telecoms, water, social or environmental infrastructure — allowing strong visibility on flows thanks to long-term contracts, with distinct risk profiles depending on the project's maturity stage.

- Brownfield assets, already operational, constitute the most defensive component: stabilized revenues, low volatility, resilience to cycles, and partial protection against inflation.

- Greenfield assets, still in development, present higher risk but superior value creation potential, particularly at the time of commissioning.

For investors, infrastructure represents a brick combining resilience, diversification, and direct contribution to the real economy.

Who can invest in private equity via Private Corner?

Wealth Management Advisors (CGP)

CGPs access a complete institutional environment to propose private equity to their clients: selected funds, allocation tools, cash-flow simulators, and consolidated reporting. Their role is to integrate private assets into the global portfolio, explain the calls/distributions mechanics, and ensure clear risk pedagogy.

Private Banks and Wealth Managers

Private banks use the platform as an open architecture of complementary strategies, integrable into multi-asset allocations. The challenge in 2026 is to build pilotable and diversified private asset pockets, responding to growing demand for sustainable performance and decorrelation.

Family Offices and Professional Investors

Family offices look for institutional quality managers, deep diversification, and access to thematic or opportunistic strategies. Their long horizon and mastery of flows make them natural candidates for a structured private equity allocation over time.

The process for investing in private equity with Private Corner

Rigorous fund selection and due diligence

Each strategy goes through an internal filter: analysis of the track record over several funds, coherence of the investment thesis, team stability, alignment of interests, valuation discipline, and ESG integration. The investment committee validates in fine, paying particular attention to readability for a patrimonial investor and the resilience of the underlying portfolio.

Digitized and secure subscription

The platform offers a fully digitized subscription journey, designed to offer distributors a fluid, compliant, and perfectly controlled process. This platform guarantees complete security of the process, with systematic verifications, full traceability, and significant reduction of error risks. It accelerates processing times and allows advisors to follow the progress of files and client commitments in real-time.

Transparent reporting and performance monitoring

Semi-annual reporting provides an updated Net Asset Value (NAV), calls/distributions flows, performance indicators (TVPI, DPI, RVPI, IRR), and a consolidated sectoral, geographical, and strategic reading that allows essential institutional visibility to pilot the private asset pocket across vintages.

The advantages of investing in private equity via an institutional platform

Pooling tickets to access top-ranked funds

Pooling (mutualisation) is the condition for access to "top-tier" managers. Without a platform, the best funds often remain out of reach because their direct minimum tickets run into the millions. By pooling commitments, an institutional platform provides access to these strategies without modifying the discipline or economic drivers.

Open architecture and geographical diversification

Operating in open architecture, the platform selects international managers across varied strategies, thus diversifying exposures by zones, sectors, and company sizes. This plurality reduces dependence on a single cycle or economy and allows building a more stable allocation over time.

Expertise and dedicated support

To enable wealth professionals to approach private markets with the right tools, Private Corner has developed the Private Assets Academy: a structured educational site (videos, guides, podcasts, fact sheets, training) to strengthen advisors' expertise with their clients.

This support also includes advanced operational backing: help with constructing allocations for our partners as well as the provision of technological tracking and reporting tools.

Performance and risks related to private equity

Investment horizon and lock-up period

Private equity is an illiquid asset class by design. The investor commits for 8 to 10 years, with progressive capital calls and distributions generally starting after 5 years. This temporality imposes adapted cash management: thinking in terms of "max cash at work" (capital actually invested) rather than nominal commitment constitutes a good institutional practice.

Risk management and portfolio diversification

Managing the risk of private assets relies on disciplined portfolio construction. Faced with illiquidity risks, dispersion between managers, or concentration, only an institutional approach to diversification allows effective mitigation.

The first defense is the selection of top-tier managers: performance dispersion is immense and a bad choice can weigh heavily for a long time. Then comes deep diversification across strategies, zones, and company sizes, as well as vintage smoothing to neutralize cycles and stabilize flows.

By combining manager excellence, structured diversification, and allocation regularity, the investor transforms a demanding asset class into a controlled source of returns.

Major risks to integrate are:

- illiquidity and lock-up duration;

- partial or total loss of capital;

- dependence on the manager (top quartile / bottom quartile dispersion);

- rate risk and leverage effect;

- operational and sectoral risks of portfolio companies.

Measuring Performance

Measuring the performance of a private equity fund: the complete guide

Evaluating the performance of a fund invested in private assets differs radically from listed markets due to a combination of elements:

- absence of continuous pricing,

- progressive capital calls and spread-out distributions.

Dedicated indicators allow understanding value creation.

The IRR (Internal Rate of Return) measures annualized return integrating the time factor. It is useful for comparing funds, but sensitive to timing. The TVPI indicates the total value created per euro called, adding distributions received and estimated residual value. The DPI reflects what has already been returned to the investor, and the RVPI what remains in the portfolio. Finally, the MOIC or Multiple offers a raw reading of the multiple generated, without a temporal dimension.

The indicators TVPI, DPI, IRR, and MOIC are explained in the article measuring performance.

| Indicator | What it measures | What it is used for |

|---|---|---|

| IRR | annualized return taking time into account | comparing funds over different durations |

| TVPI | total value (realized + residual) / capital called | measuring global value creation |

| DPI | distributions received / capital called | tracking fund maturity and liquidity |

| RVPI | residual value / capital called | estimating remaining potential |

| MOIC | gross multiple on invested capital | simple reading of value created |

These indicators must be placed within the context of the J-Curve: in the early years, fees and the absence of exits weigh on performance; then, the first disposals initiate the rise; finally, at maturity, distributions converge, and the return takes on its full meaning.

Conclusion – Summary

Private assets have established themselves as an unavoidable brick of patrimonial diversification. Regulatory opening accelerates adoption, while the economic environment reinforces the interest of strategies anchored in the real economy.

Build your private assets allocation

Are you a Wealth Advisor, Private Bank, or Family Office? Let's discuss structuring a core/satellite private assets pocket, optimizing flows, and accessing the best institutional strategies via Private Corner.

Book a meeting