What is private equity? Definition and core principles

Private equity: definition

Private equity is an asset class that involves taking equity stakes in privately held (non-listed) companies, with a long-term approach, active involvement, and a focus on operational value creation.

Unlike public markets, it is typically structured around closed-end funds, deferred liquidity, and performance that is built over time before it is ultimately realised. Long reserved for institutional investors, private equity is now accessible to sophisticated private investors through regulated investment vehicles, provided they understand the economic, legal, and wealth-planning mechanisms involved.

How private equity differs from public market investing

The difference between private equity and listed assets is both structural and conceptual.

Public markets offer continuous liquidity but expose investors to high volatility, largely influenced by financial flows and market sentiment. By contrast, private equity is characterised by the absence of daily price quotations and valuation approaches grounded in underlying economic fundamentals.

| Criterion | Private Equity | Public Markets |

|---|---|---|

| Type of companies | Private (unlisted) | Listed |

| Time horizon | Long-term (8–12 years) | Short-term / liquid |

| Liquidity | Low | Daily |

| Value creation | Operational | Financial / market-driven |

| Volatility | Not observable daily | High |

In private equity, time is not a risk to manage—it is a performance lever.

The role of fund managers and private equity funds

Fund managers (General Partners – GPs) sit at the heart of the model.

They do not merely allocate capital: they define an investment thesis, select companies, support management teams, and organise exit routes.

As a result, private equity performance depends primarily on:

- the quality of the investment team,

- their experience across multiple vintages,

- their ability to execute a strategy across varied economic environments.

How does a private equity investment work?

The life cycle of a private equity fund

A private equity fund is a closed-end vehicle, typically structured for 8 to 12 years, sometimes with extensions.

Investors commit a total amount (the commitment), which is drawn down progressively as the fund makes investments.

The fund life cycle generally unfolds in four phases:

- Fundraising, during which commitments are collected;

- Investment period, over four to five years;

- Value creation, through active portfolio company support;

- Exits and distributions, before the fund is wound up.

This time profile explains the “J-curve” dynamic that is typical of private funds.

From capital calls to exit: key steps

Unlike a listed investment, capital is not deployed immediately. Capital calls are made progressively, often around 15% to 25% per year (sometimes more in the early years).

Distributions generally begin from year five onwards, as the first exits are completed.

It is important to note that investors commit to an amount, but this amount is not always drawn down at 100%. This creates staggered cash flows over time, which must be factored in when building an allocation.

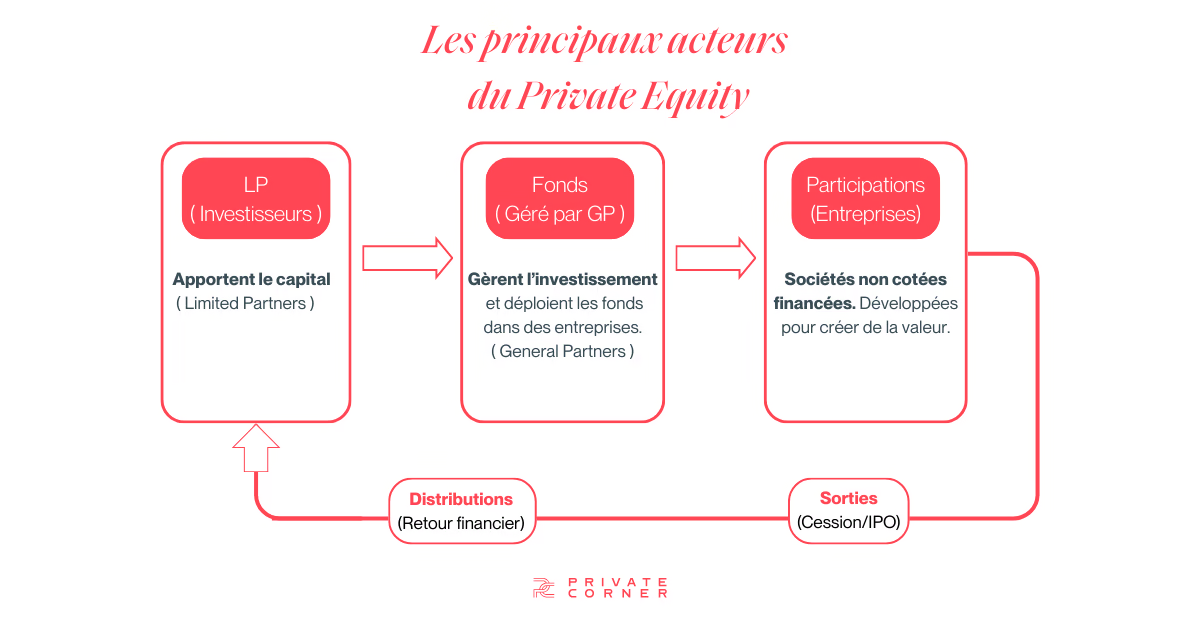

Private equity stakeholders: LPs, GPs, and portfolio companies

Private equity relies on a clearly defined chain of participants:

- LPs (Limited Partners), who provide capital;

- GPs (General Partners), who invest and manage it;

- Portfolio companies, which drive value creation.

Alignment of interests is reinforced by GP co-investment in the funds they manage.

Key private equity strategies

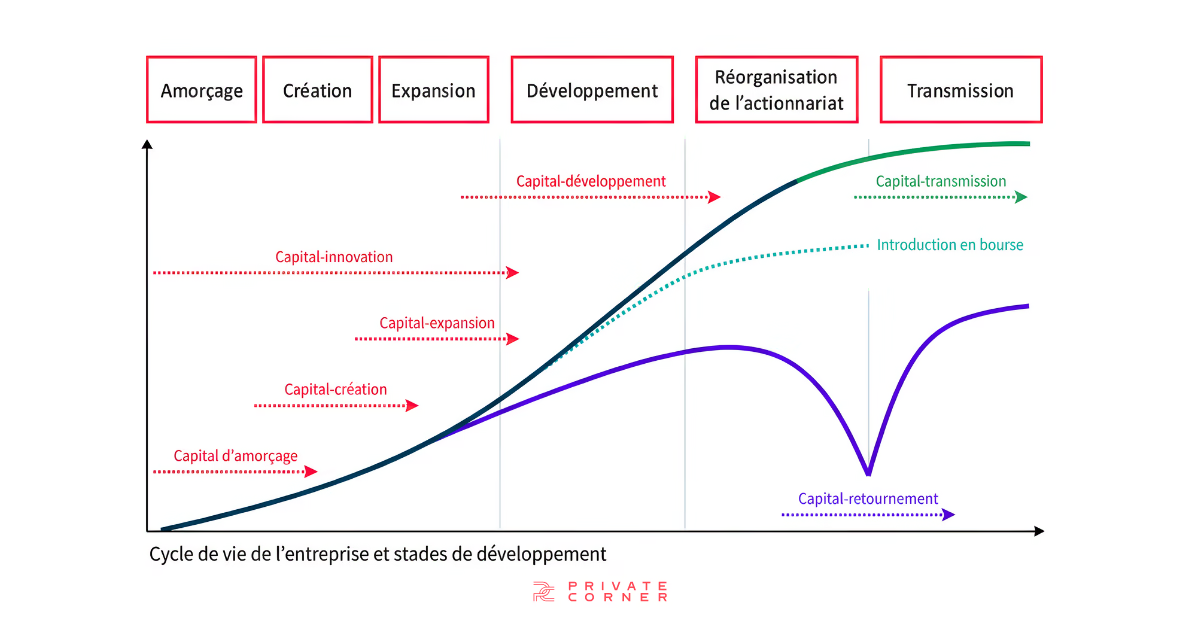

Venture capital: financing high-growth companies

Venture capital finances young and innovative companies, often before they reach profitability.

Risk is high and outcomes are dispersed, but value creation can be significant when a subset of companies reaches critical scale.

Growth equity and buyouts: growth and leveraged acquisitions

Growth equity targets profitable companies seeking to accelerate expansion (international growth, acquisitions, organisational build-out).

Buyouts (capital transmission) support the acquisition of mature businesses, often via leveraged structures.

In these strategies, value creation primarily comes from operational improvement, governance, and strategy—far more than from financial engineering.

Secondaries and co-investments in private equity

The secondary market allows investors to acquire existing portfolios, often with better visibility on underlying assets and future cash flows.

Co-investment provides direct exposure to selected deals alongside flagship funds, typically with lower fees.

🔎 Explore strategies available through Private Corner

Discover our offeringStrategy selection depends on: time horizon, tolerance for illiquidity, risk level, objective (growth, income, diversification), and the ability to diversify across vintages.

What is a private equity fund?

Structure and organisation of a private equity fund

A private equity fund is an Alternative Investment Fund (AIF), governed by the AIFM Directive and supervised by the AMF.

It centralises commitments, capital calls, distributions, and reporting within a secure legal framework aligned with institutional standards.

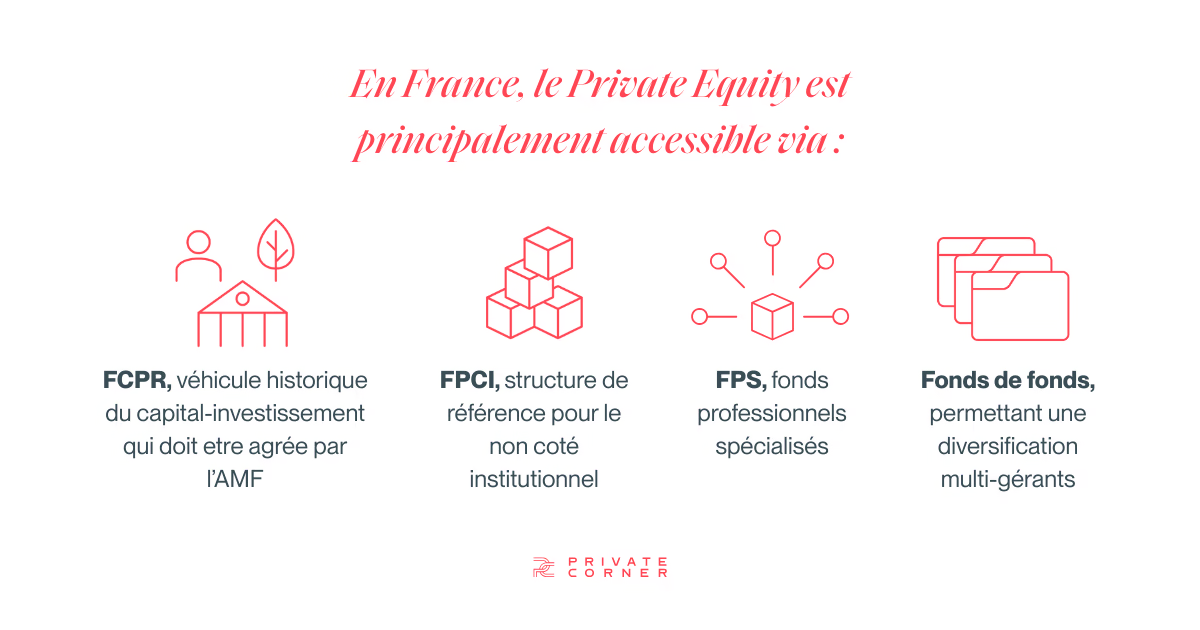

Fund types: FCPR, professional funds, and fund-of-funds

In France, private equity is primarily accessed through:

- FCPR, the historic private equity vehicle, which must be approved by the AMF;

- FPCI, a reference structure for institutional private markets;

- FPS, specialised professional funds;

- FIPS, specialised professional investment funds;

- Fund-of-funds, enabling diversification across multiple managers.

The vehicle chosen determines tax treatment, governance, risk profile, and liquidity.

Investment horizon and lock-up period

The investment horizon is a core feature of private equity.

Private equity investing takes place over a long period, which is necessary for real-world business transformation. This duration reflects the value-creation cycle—not an artificial constraint.

The trade-off is structural illiquidity. Funds are closed-end and do not offer redemptions at the investor’s initiative. However, this illiquidity should be understood in context: capital calls are progressive and distributions occur before the end of the fund’s life.

Private equity in France and globally

The French private equity market: key figures

In 2024, private equity investment in France totalled €36.9bn (according to a France Invest / Grant Thornton study). France is among Europe’s most dynamic markets, with tens of billions of euros invested each year in private companies. Private equity plays a central role in financing SMEs and mid-caps, supporting business transfers, and structuring entire sectors.

Billions invested each year in Europe

Across Europe, €126bn was invested in private equity in 2024—up 24% versus 2023—according to an Invest Europe report.

Institutional investors allocate an increasing share of portfolios to this asset class, notably for its potential to generate long-term performance.

Leading private equity investment sectors

Investments tend to focus on high-potential sectors such as:

- healthcare,

- software and B2B services,

- specialised industry,

- infrastructure and the energy transition.

More broadly, funds aim to support major transitions in healthcare, technology, and sustainability.

Why invest in private equity? The benefits

Performance and growth: attractive long-term potential

Private equity fits within a long-term wealth allocation framework rather than an opportunistic hunt for yield.

It enables endogenous value creation driven by operational improvement in portfolio companies. It also offers structural diversification—economic, temporal, and strategic—relative to public markets.

Over time, private equity can contribute to “self-financing” an investor’s commitments as distributions from mature funds offset new capital calls.

Diversifying a portfolio with private companies

The diversification benefit of private equity should not be reduced to a simple statistical “decorrelation”. It is structural, because it relies on different value drivers than public markets.

First, investing in private companies provides access to a broader economic universe than stock markets: many value-creating SMEs and mid-sized companies are not listed, and some high-potential firms stay private for longer. Private equity therefore exposes portfolios to growth trajectories and transformation stories that do not appear in listed indices.

Second, diversification is also temporal. Building a portfolio across multiple vintages (successive commitments) reduces the risk of relying on a single “entry point”. Each investment year captures a different valuation and cycle environment, mechanically smoothing timing risk.

Finally, diversification is economic and operational. While listed performance may be heavily driven by multiple expansion and market flows, private equity aims for more endogenous value creation: margin improvement, business model optimisation, bolt-on acquisitions, and governance professionalisation. This can help reduce reliance on a single performance driver.

Supporting the growth of SMEs and mid-sized businesses

One of private equity’s core contributions is its ability to support SMEs and mid-sized businesses over the long term—well beyond the injection of capital.

Unlike traditional financing, private equity is built on a long-term partnership, aligned with the strategic objectives of the companies it backs.

Private equity funds step in at key moments in a company’s life: acceleration phases, governance structuring, shareholder transitions, operational transformation, or sector consolidation. At these stages, bank financing or public markets are often ill-suited—too rigid or insufficiently patient.

The contribution of private equity is therefore twofold. First, it is financial: strengthening equity, securing the balance sheet, and funding external growth or investment plans. Second, it is operational and strategic: providing sector expertise, strengthening key functions, professionalising processes, and supporting management decision-making.

This approach gives funds the role of true long-term partners, able to support business scaling over time. For investors, this proximity to the real economy is a distinct value driver, rooted in business transformation rather than financial trading.

Key private equity risks to understand

Risk of capital loss and illiquidity

Private equity involves the risk of partial or total capital loss. Private companies may face operational, sector, or macroeconomic shocks, and performance dispersion is higher than in public markets.

This risk is inseparable from long-term value creation. Private equity performance is driven by the gradual transformation of businesses, which implies greater short-term uncertainty, offset by long-term return potential.

Added to this is structural illiquidity. Private equity funds are closed-end: investors cannot request redemption at any time. Exits depend exclusively on the timing of portfolio disposals.

That said, illiquidity should be nuanced: capital calls are progressive and distributions typically occur before the end of the fund’s life, spreading capital immobilisation over time.

Long investment horizon and multi-year commitment

Investors must accept prolonged capital lock-up and limited short-term visibility.

How to manage risk in private equity

Risk management relies on:

- diversifying strategies and vintages,

- rigorous selection of fund managers,

- active cash-flow planning.

Who can invest in private equity?

Institutional and professional investors

Private equity is primarily intended for professional or sophisticated investors who can understand its risks and constraints. It is a complex, non-standardised asset class combining closed-end funds, successive capital calls, deferred distributions, and specific legal structures. This complexity makes a standalone approach ill-suited.

The absence of liquidity and daily pricing requires deep upfront analysis (team quality, fund structuring, alignment of interests) and ongoing management of cash flows and allocation over time. Without support, the risk is miscalibrating commitments, diversification, or liquidity exposure.

The role of investment platforms such as Private Corner

Accessing private equity requires specialised expertise, both in selecting funds and in structuring and monitoring investments. Specialised platforms act as an interface between institutional private markets and wealth management professionals.

In this context, Private Corner, as an AMF-authorised management company, operates as a specialist in private market assets. Its role is to provide access to institutional strategies within a structured framework, aligned with regulatory standards, and designed for long-term clarity.

Beyond access, this type of platform provides an allocation methodology, long-term guidance, and monitoring tools that embed private equity into a coherent wealth strategy—rather than an opportunistic or isolated investment.

Minimum ticket sizes and accessibility

Access to private equity is governed by minimum subscription thresholds designed to ensure investors have the financial capacity and the sophistication required to understand this asset class.

In most cases, professional funds (notably FPCI, FPS, FIPS) are accessible from €100,000, unless a specific regulatory exemption applies. These vehicles are mainly intended for professional or sophisticated investors due to their complexity, illiquidity, and long investment horizon.

A notable exception concerns AMF-approved FCPRs, which may be offered to non-professional investors. In that case, the management company can set the minimum subscription amount, subject to the regulatory framework and investor protection obligations. This flexibility aims to broaden access to private equity while maintaining a high level of information and education.

Conclusion

Private equity is a distinct asset class that cannot be reduced to either a yield alternative or a simple financial diversification tool. It fits within a demanding wealth allocation approach, built on long-term discipline and time.

In summary, private equity:

- is driven by progressive, operational value creation within private companies;

- involves structural illiquidity as the direct trade-off for long-term performance potential;

- requires rigorous selection of fund managers and a solid understanding of investment vehicles;

- integrates sustainably into an allocation when approached as a cash-flow strategy rather than a one-off investment;

- benefits from specialised guidance to manage risks, commitments, and long-term monitoring.

When approached with method and institutional discipline, private equity becomes a structuring tool for wealth construction—delivering durable performance and financing the real economy directly.

Speak with Private Corner

Would you like to structure a private markets allocation (private equity, private debt, infrastructure) with an institutional approach to selection, diversification, and cash-flow management?

Book a meetingFAQ – Frequently asked questions

What does “private equity” mean?

Equity investing in privately held (unlisted) companies.

What is private equity?

An asset class dedicated to financing and supporting private companies.

What is a private equity fund?

An alternative investment fund (FPCI, FPS, FCPR, etc.) investing in multiple private companies.

Why invest in private equity?

To create long-term value, diversify wealth, and finance the real economy.

What is the difference between private equity and venture capital?

Venture capital finances younger, riskier companies (innovation, early stage). Private equity also includes strategies targeting mature companies (growth, buyout, secondaries).

What is the average duration of a private equity investment?

Typically 8 to 12 years per fund (sometimes extended), with capital calls and distributions spread over time.