This guide provides the essential keys to investing in Private Equity in France: return prospects, risks, and the different ways to gain exposure to private markets.

Private Equity differs from listed assets: unlike shares traded on a regulated market, an equity stake in an unlisted company is typically held over a longer horizon, with lower liquidity and a distinct investment cycle.

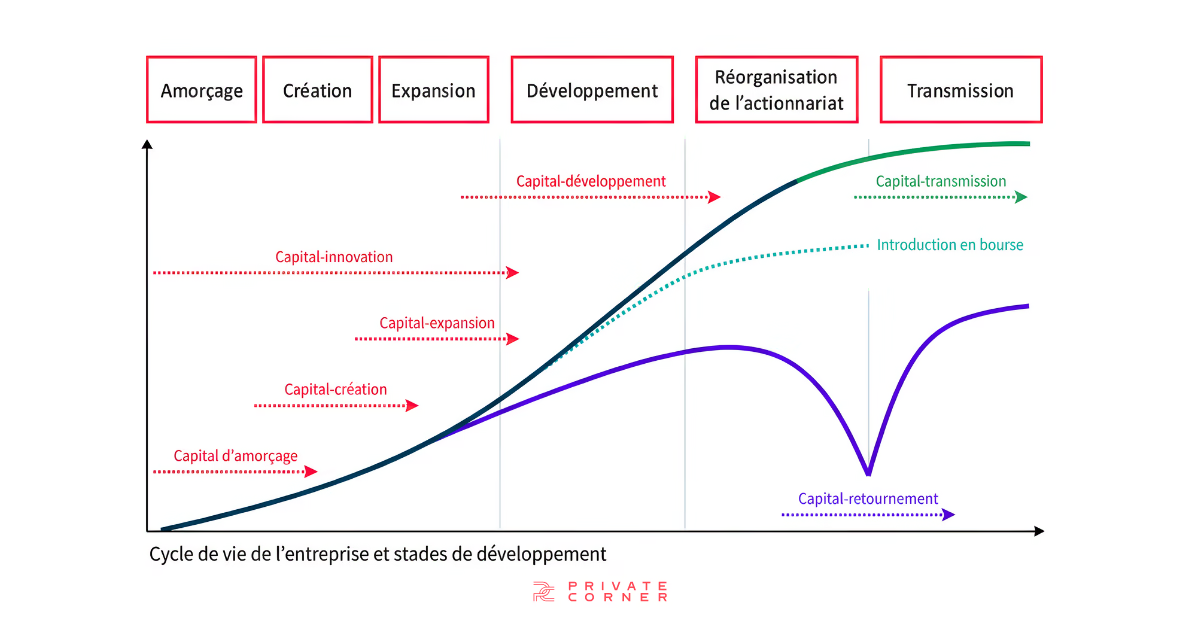

The main forms of private equity

Investing in private equity is not straightforward, as the asset class is highly diverse—just like the investment funds dedicated to private markets:

Venture capital

A form of financing designed for innovative young companies (start-ups) with strong growth potential. It is a high-risk investment, made by investors who provide capital in exchange for an equity stake, with the prospect of substantial long-term returns.

Buyout (capital transmission)

An acquisition transaction: investors provide capital to acquire a majority or full stake in an established company, often in the context of a change of ownership, succession or business transfer.

Growth / expansion capital (capital development)

Financing for SMEs and mid-caps that are already established and have reached a degree of stability and profitability, but require capital to accelerate growth, expand operations or fund specific projects.

Turnaround / restructuring capital

Investments aimed at restructuring and revitalising companies facing financial or operational distress.

The principal types of investment funds

Funds are notably differentiated by their investment strategy (stage, sectors, geographies, value-creation approach).

Early-stage funds

Investing in an early-stage fund means investing in a vehicle specialised in financing start-ups and companies in the very early phases of their development cycle.

Growth equity funds

Positioned between venture and traditional private equity: these funds invest in more mature businesses—often already profitable—that require capital to fund expansion, commercial development or consolidation.

Venture capital funds

Funds specialised in financing high-potential start-ups, in seed or early development phases, to fund growth, product development and market expansion.

Buyout funds

LBO funds acquire companies with a view to restructuring, developing and ultimately selling them at a profit (operational improvements, synergies, strategic investments, etc.).

Note: these funds may also be sector-focused (tech, agriculture, infrastructure, energy transition, etc.).

How to invest in private equity

Whether investing directly, through a private markets fund, a fund of funds, or via life insurance, investors have several routes to access private equity—each aligned with different objectives, risk profiles and investment horizons.

Direct investment

Direct investment in an unlisted company typically requires substantial amounts and is primarily aimed at institutional investors, very high-net-worth individuals, or business angels with the requisite expertise and financial capacity.

Investing through a private markets fund

Subscribing to a private equity fund means investing via an asset management company authorised by the Autorité des marchés financiers (AMF), which pools capital from multiple investors within a dedicated investment vehicle to deploy into unlisted companies.

The fund is managed by professionals in line with a clearly defined investment strategy (stage, sectors, geographies, investment thesis), with the objective of identifying high-potential companies and generating returns for investors. Subscribing to fund units entitles investors to a proportional share of gains—or losses—realised.

Subscribing to a fund of funds

Another way to diversify a portfolio with private assets is to subscribe to a private equity fund of funds, which does not invest directly in companies but allocates capital across multiple private equity funds. This approach offers broad diversification—across strategies, management companies, sectors and geographies.

Investors seek both the pooling of underlying managers’ expertise and a reduction in risk through diversification. Funds of funds also tend to offer lower minimum commitments than direct subscription to certain private equity funds.

Investing via life insurance

It is also possible to invest in private equity through a life insurance contract by allocating part of one’s capital to private equity funds, via the unit-linked instruments offered by the contract. This solution integrates private assets within a broader wealth allocation—alongside traditional holdings such as euro-denominated funds, equities, bonds or real estate funds—while benefiting from the tax and estate-planning framework specific to life insurance.

The PACTE Act and private equity

The PACTE Act (Plan d’Action pour la Croissance et la Transformation des Entreprises), adopted in 2019, aims to modernise the French economy and encourage long-term investment, notably in unlisted companies.

It has helped make private equity more accessible by facilitating the financing of SMEs and growth companies, while supporting the emergence of new investment structures and digital players—within a regulatory framework supervised by the AMF.

Platforms, feeder funds and funds of funds

For a long time, private equity remained accessible to only a limited group of investors due to high minimum tickets. The rise of dedicated subscription platforms has progressively addressed the growing demand from private investors seeking to diversify their wealth with private assets.

Acting as a bridge between private investors’ advisers and asset management companies, an AMF-regulated platform such as Private Corner helps broaden access to the asset class and supports this democratisation trend. In practice, it connects private investors with opportunities to invest in unlisted companies.

These platforms typically structure so-called feeder funds, which invest in carefully selected underlying funds (master funds), themselves invested in companies with strong growth potential. They play a central role in selecting and assessing opportunities, managing and monitoring investments, and facilitating communication and reporting— often supported by digital tools.

By facilitating access to private equity and streamlining interactions between investors, advisers and asset managers, these platforms contribute meaningfully to the democratisation of the asset class.

Who can invest in Private Equity in France?

Typical participants include:

- institutional investors (pension funds, insurers, banks, foundations, etc.),

- specialised investment funds and investment companies,

- family offices,

- high-income individual investors,

- public-sector actors, etc.

Thanks to private equity platforms, private individuals with meaningful wealth—without necessarily investing several million euros—can now access private equity by subscribing to private asset funds from €100,000.

It should be noted that private equity investing is generally reserved for qualified investors, notably due to the risks involved and liquidity constraints, depending on the vehicle.

Advantages and drawbacks of Private Equity

Advantages (for investors)

- Potentially attractive long-term returns.

- Access to distinctive opportunities (unlisted companies).

- Diversification: reduced dependence on traditional markets.

- Long-term horizon: value creation typically built progressively (often 5 to 10 years).

Important: past performance is not indicative of future performance.

Drawbacks (for investors)

- Lower liquidity (funds are typically locked up for several years).

- Higher risk (capital loss is possible).

- Minimum investment can be high depending on vehicles and access channels.

- Capital lock-up and limited flexibility.

- Perceived lack of transparency (valuation, reporting)—hence the importance of choosing transparent actors.

Advantages (for companies)

- Access to capital to finance growth.

- Expertise and support (management, strategy, network).

- Flexibility in investment and exit structures.

- Alignment of interests (long-term value creation).

Drawbacks (for companies)

- Potential for increased investor control.

- Pressure on profitability (sometimes perceived as short-termist).

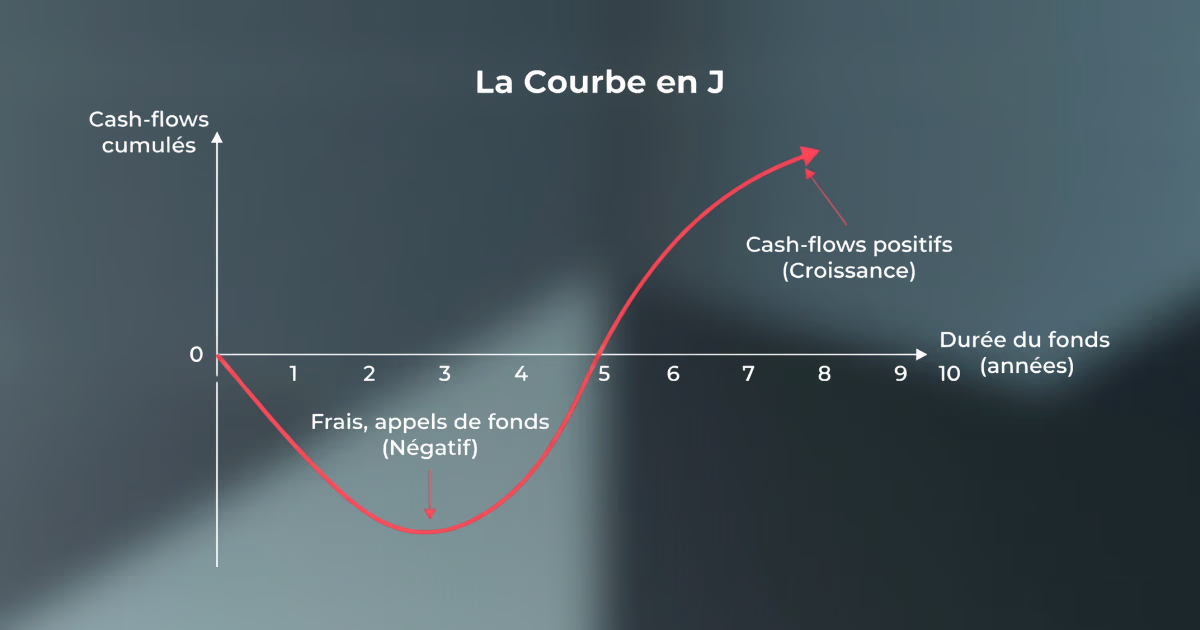

What is the J-curve?

The J-curve describes the typical evolution of a private equity fund’s performance over its life. It is characterised by an initial period of weak or negative performance, followed by gradual—and then accelerating—value creation.

At the outset, performance is weighed down by the progressive deployment of capital, management fees, and the time required to transform portfolio companies. This phase is essential to allow portfolio companies to professionalise, grow and improve profitability.

In a second phase, operational momentum within portfolio companies and the occurrence of liquidity events (sales or IPOs) can lead to a marked increase in the fund’s value.

While some investments may underperform, the J-curve logic rests on the ability of the best outcomes to offset potential failures—without any guarantee of performance. It therefore illustrates the intrinsically long-term nature of private equity investing, structured around portfolio construction and subsequent value realisation.

Private assets: companies, real estate, infrastructure

Private equity broadly encompasses three main investment categories: unlisted companies, real estate and Brownfield or Greenfield infrastructure.

It enables investors to support private companies at different stages of maturity, finance and enhance real estate assets, or invest in essential infrastructure—often offering more stable and predictable revenue streams.

This diversity provides investors with a broad range of private-market exposures, combining value creation potential, diversification and differentiated investment horizons.

The two main performance metrics

The two most commonly used performance indicators in private equity are the Internal Rate of Return (IRR) and investment multiples.

IRR measures the annualised growth rate of an investment by incorporating all cash flows (capital calls and distributions) and their timing. It is a key metric to assess a fund’s performance over time.

Investment multiples compare the total capital invested with the total capital returned. A multiple above 1 indicates a positive outcome, but it does not capture the time dimension.

Other metrics such as DPI can help analyse distributions in greater detail.

Key tax considerations for private equity

“Non-tax-advantaged” FPCI

Non-tax-advantaged FPCIs are subject to the 30% flat tax (prélèvement forfaitaire unique) on capital gains and distributed income, including income tax and social contributions.

“Tax-advantaged” FPCI

Tax-advantaged FPCIs may, under certain conditions, benefit from an exemption from income tax on capital gains, notably provided that units are held for at least five years; social contributions remain due.

Private equity via life insurance

Finally, investing in private equity through a life insurance contract falls under the tax rules specific to that framework, with taxation arising only upon withdrawal, and enhanced long-term and estate-planning advantages.

These points reflect general principles and must be assessed in light of each investor’s situation and the regulations in force.

What about the private equity investment cycle?

There are typically three major stages in the investment cycle:

- Capital calls: capital is called progressively by the management company, as investment opportunities arise and financing needs materialise.

- Distributions: investors receive returns of capital and capital gains as portfolio companies are sold (trade sale, secondary sale, IPO, etc.).

-

Exit: at fund maturity, units are redeemed or sold in accordance with a timetable and terms defined from inception.

Focus: What is an FPCI?

An FPCI (Fonds Professionnel de Capital Investissement) is an investment vehicle designed to invest in unlisted companies.

It is a professional investment fund managed by a specialist management company, subject to a compliance framework (AMF rules, disclosures, subscription conditions).

Depending on the structuring, certain vehicles may resemble mutual-fund-like arrangements, i.e., collective structures where multiple investors hold units in a single portfolio managed according to a defined strategy.

FPCIs are private equity funds reserved for qualified investors (institutionals, insurers, banks, pension funds). They enable investment in unlisted companies with potentially attractive returns, in exchange for higher risks—most notably lower liquidity and greater valuation uncertainty.

These funds may be sector-focused or diversified and can invest in SMEs, start-ups or mid-sized companies. Their life is limited, and performance typically depends on the sale of portfolio holdings or IPOs. Access to FPCIs is strictly regulated by the AMF, unlike certain private equity investments accessed via platforms aimed at a broader audience.

Conclusion

Private equity investing can take several forms and may offer attractive return prospects, while exposing investors to risks (capital loss, illiquidity, long duration). It most often requires support from a wealth adviser (CGP), a family office or a private bank.

To learn how to invest in a private equity fund or discover the funds accessible via Private Corner, please contact your adviser.

Disclaimer:

This is a marketing communication. Private Corner is authorised as a portfolio management company on 05/11/2020 by the AMF under number GP-20000038.

Investing in private markets involves, in particular, risks of capital loss and illiquidity.